Indian banks are stepping up their efforts to attract deposits from non-resident Indians (NRIs), particularly in Kerala, a key region for NRI remittances. To tap into the growing NRI customer base, banks are enhancing their operations in the Gulf countries and introducing specialized products and services.

In Kerala, known for its significant NRI deposit inflows, banks are facing increased competition as they strive to meet the demand from both NRIs and residents seeking higher returns on investments.

"NRI deposits, typically larger in size and with regular inflows, offer a valuable source of long-term funding. Many NRIs look for secure, profitable options to invest their funds domestically, which makes this segment a reliable and stable source of deposits," said Shalini Warrier, Executive Director at Federal Bank.

Tamilnad Mercantile Bank (TMB) has plans to set up a global NRI center in Kochi to attract customers from the Gulf as well as from Singapore and Malaysia. TMB’s Managing Director, Salee Nair, stated, "We are focusing on the NRI segment. It currently represents about 4% of our total deposits, and we aim to increase that to over 10%."

CSB Bank, based in Thrissur, is planning to open a representative office in the UAE and a global remittance platform. Additionally, the bank launched a dedicated NRI branch near Kozhikode International Airport in September, complete with a 24-hour lounge facility aimed at attracting more NRI customers. Kozhikode is one of the busiest airports in Kerala for NRI travel.

South Indian Bank, based in Kerala, has introduced NRI-SAGA, a special product designed for salaried NRIs.

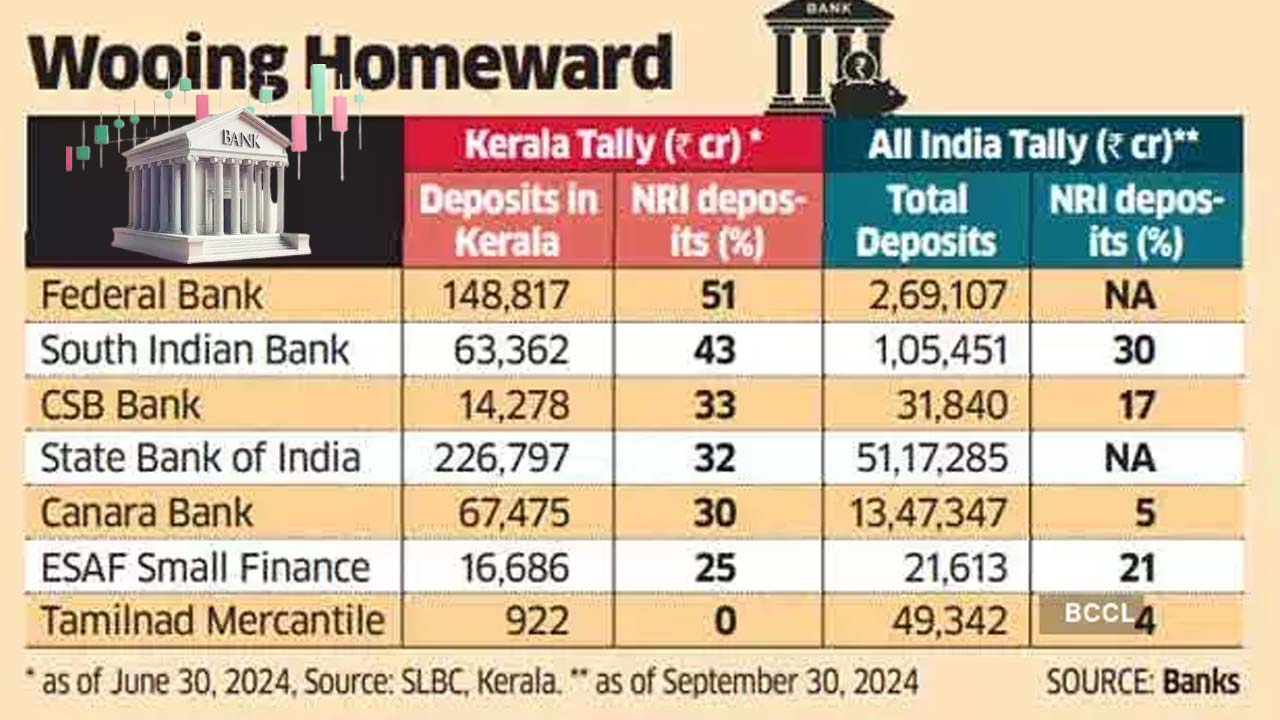

Kerala remains the leading market for NRI deposits and remittances, with an estimated Rs 2.2 lakh being sent home annually to each household in the state. According to the state-level bankers' committee report, NRI deposits increased by 11% year-on-year, reaching Rs 2.74 lakh crore by June, up from Rs 2.47 lakh crore the previous year.

Canara Bank, headquartered in Bengaluru, operates an NRI processing hub in Ernakulam. "We target NRI deposits in Kerala through regular meets during major festivals such as Onam, Christmas, and Eid, and maintain close ties with Norka Roots, a Kerala government department focused on NRI affairs," said Managing Director K Satyanarayana Raju.

Banks originating from Kerala naturally have a strong foothold in the Kerala-Gulf Cooperation Council (GCC) corridor. "Leveraging this strength, we have expanded our presence in the GCC to capture a larger share of the non-Kerala-GCC remittance flows. We’ve also established branches in migration states like Jharkhand, Chhattisgarh, and Uttar Pradesh to tap into these new corridors," explained Shalini Warrier of Federal Bank.

ESAF Small Finance Bank's Managing Director, K Paul Thomas, echoed similar sentiments, emphasizing the importance of both the Kerala market and emerging markets outside the state, such as Maharashtra, Tamil Nadu, Karnataka, Delhi, and Hyderabad.

Canara Bank also sources NRI business through its representative offices in Sharjah and branches in London and New York, in addition to partnerships with exchange houses across the Middle East to facilitate remittances.