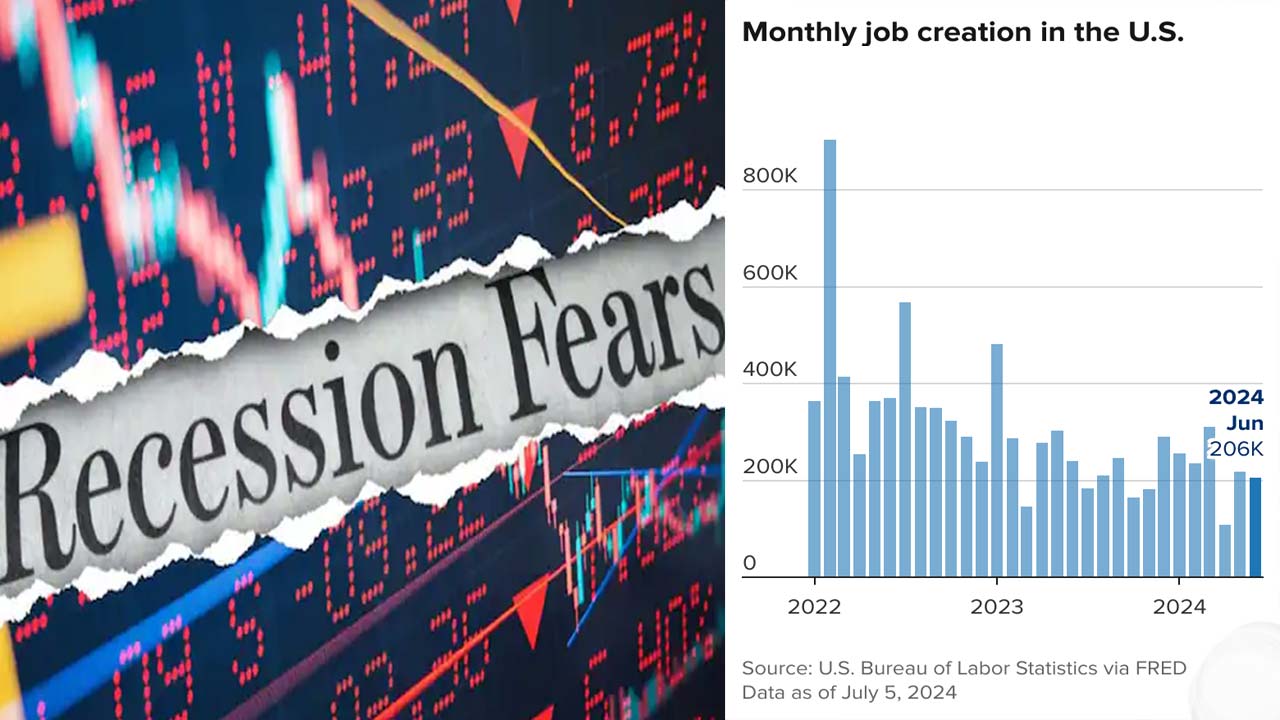

USA: The August jobs report, set to be released later today, is expected to offer key insights into the health of the US labor market, potentially impacting the Federal Reserve's upcoming interest rate decisions. The recent rise in the unemployment rate has raised concerns about a potential recession, with a further increase likely to intensify these fears. However, a stable or declining unemployment rate could ease recession worries and indicate a resilient economy.

Unemployment Trends and Recession Fears

The US unemployment rate jumped to 4.3% in July, up from 3.4% in April 2023. If this trend continued in August, it could signal the onset of a recession. However, if the unemployment rate stabilizes or declines, it may suggest that July's increase was a temporary anomaly, providing hope for economic stability.

Federal Reserve's Rate Cut Decision

The Federal Reserve is poised to cut its first-rate since the pandemic during their meeting on September 17-18. The magnitude of the cut, whether a quarter-point or half-point, may hinge on the strength of the labor market, making the August jobs report a key factor in the decision-making process.

Global Impact of the US Jobs Report

The upcoming jobs report is not only vital for the US economy but could also shape global financial markets. According to Julia Coronado of MacroPolicy Perspectives, the data will set the tone for both the Federal Reserve and global monetary policy. A strong report could drive interest rate hikes, affecting global markets, while a weak report could stoke recession fears and cause market fluctuations.